Where and how to play in Edtech, from an operator

An attempt to map the ecosystem and understand what works and what doesn't

by Harry Kapoor and Rachita Kumar

Welcome to yet another newsletter episode where we dissect a sector and try to understand the opportunities that exist for our entrepreneurial community.

If you are someone looking to work or start up in the Edtech space, do reach out- have some interesting opportunities from our network.

FutureX is an invite-only community for curious life-long learners to keep up on business and tech trends, and develop mental models for a purposeful life.

Click here to join FutureX Learning community on WhatsApp. If you are looking for a co-founder or to join a startup, join our startup fellowship program here or reach out.

If you haven’t already, consider subscribing to our newsletter 👇

I have been meaning to write this detailed piece on the Edtech industry for quite some time now. Every once in a while someone reaches out to me to understand the space, and I thought it’d be better to document it and share with the ecosystem at once.

Bear with me through this extensive piece. I will attempt to divide it into the following key segments but keep it as a single-scroll read. Feel free to read in parts!

Why work in Education/ Edtech

The market landscape and how to approach the market

What really works and what doesn’t to build a large company

Whitespaces/ opportunities in K12 and Higher Education

Deep-dive on the individual market segments (v2)

Why work in Education/ Edtech

To give you some context, I have had exposure to both B2C and B2B Edtech products, and have dabbled across K12, Test Prep and Higher Ed as well.

I feel quite passionately about solving the problems that exist in our education system today and here are the reasons I chose to work in Edtech, and why you might also want to consider working in Education:

Impact and Built-in network effects: The impact transits to future generations of the current customers, their families, and network. One educated person can influence and impact the entire ecosystem. Most powerful tool for humans.

Least innovation/ adaptation, and having outdated practices: If you think of it, Education has witnessed the least evolution amongst other sectors like Banking, E-commerce, Retail etc. The classroom-style teaching adopted in the industrial era to train humans as labour for industrial units continues as-is till date.

Large market and potential to attract the best talent: With 300M students in school and another 300M+ requiring continuous learning, combined with the willingness to spend on education irrespective of the income level, makes Education one of the largest markets both in terms of users and revenue. The best talent is attracted towards the scale of impact possible in the business.

Founder-Market fit: You should deeply understand the problems you are trying to solve, whether for parents, students or teachers. Having gone through the education system not so long ago and keeping in touch with the exact TG has helped me immensely in understanding the users in-and-out. I have also been able to develop empathy towards the other key stakeholder - teachers, thanks to my mother who has been a teacher for 25+ years now.

Do you relate? Would love to hear about your interests in the space- DM me.

The market landscape and how to approach the market

Now, let's dive right in and have a look at the entire Education landscape by breaking it down into four key segments, based on the lifecycle of a learner's journey.

K12 (primary skills) incl. pre-school

Test preparation (to enter the competitive higher education and job market)

Higher Education (core skills to get ready for job)

Continuous learning (upskilling and reskilling)

Note: Every person, today, is a learner/ student for life.

Some divide the continuous learning market further into Serious Academic-oriented Learning and Casual Hobby-based Learning. Additionally, K12 is preceded by the pre-school market.

Below is the market size of the overall Education space and the Online Learning/ Edtech space based on a report published in 2017, but the latter has witnessed accelerated adoption because of the COVID pandemic and learn-from-home scenario.

As we can imagine, the Edtech user base would have skyrocketed as most of the ~300M students have had to compulsorily shift to online learning. We can expect it to be well over 100M students (given byju's alone claims to have 40M).

And we can estimate a range of 7-10M users as paid EdTech users (byju's alone claims to have 3M).

Oftentimes, entrepreneurs spend too much time arguing about the market size, but I feel each of the 4 segments above easily qualify for a multi-billion dollar market, perhaps in a few years if not already.

Having established the segments, we now discuss two ways of approaching the market.

B2C: selling directly to the consumer

B2B (or B2B2C): selling to the institutes or to the students through the institute

Should you pick B2C or B2B?

The B2B model seems lucrative to acquire a high volume of customers at once, but suffers from a slew of challenges: adversely long sales cycle, thin margins, difficulty to recognise and meet the decision making authority, lack of early adopters and tech-savvy customers, and a major conflict between profit maximisation (% revenue split with school) vs. quality of actual product/ learning outcomes delivered. Most schools are concerned only about the former.

It is tough to penetrate a market at scale when dealing with schools, colleges and institutions. There are few players till date who have been able to crack this market and who run a highly scalable and profitable enterprise. KOOH Sports, Edusports and Leapstart are a few players who have scaled to a sizeable user base and revenue (of Rs. 100 Cr+ perhaps) but took over 8 years to get there with neither a very bullish growth rate nor very high margins.

That said if you understand the working and incentives of the schools/ institutes and are genuinely helping them earn more revenue (yes, that's more or less the incentive) while solving a key pain point or making them look better than others, you are competent to build a profitable business. What does work in B2B to an extent is FOMO and competitive benchmarking. If you are able to onboard some key institutes in a city and pitch about it to competing institutes, they might give in (think how Smart class tech- Educomp etc. broke into the market making smart class boards a necessity today). But note that few smart class companies were able to survive/ do well because of the reasons highlighted above.

There is a new emerging space of mass B2B (or B2B2C) where players like Classplus, Teachmint, Embibe etc. are enabling the coaching institutes and tuition teachers to go online (which has seen accelerated adopted because of COVID19). Some of the players in this space are providing a simple online teaching platform, while some are giving advanced features like tests, assignments, homework, attendance etc. Again, the revenue model/ potential exclusively of this space is limited, and these players would have to look beyond for scaling revenue.

Personally, I have a large bias towards building a consumer business (B2C) if you genuinely have a good product and are confident that you are solving a genuine problem for your customer. That said, it's important to understand carefully that even in B2C, the customer and consumer are both different- parents are the customers and children the consumers, in most cases.

The COVID effect

For sure, COVID-19 has accelerated the adoption of technology and third party products/ tools for the schools/ institutes. All the teachers and staff have had to adopt digital tools for online teaching compulsorily, giving the ever-so-opportunistic entrepreneurs a hope to convert the institutions faster and at scale.

That said, the majority of the schools are facing the heat of fee defaults, cutting down teachers’ salaries and fighting the challenges of survival. They have been quick to adopt tools which are free of cost, and several companies like Google Meet, edtech companies like Vedantu, Toppr, Great Learning etc. have rolled out free subscriptions to online teaching tools for schools/ teachers.

It will be interesting to see the uptick in sale of paid products for schools and if any large company is tapping the opportunity. Please do share in comments if you are aware.

Operating Model

Another question a founder in the Edtech space has to answer is how do they want to operate the company. Whether they want to make the content in-house and run a sales team, or outsource the functions to other stakeholders. Few models that exist are as follows:

Open Marketplace: Simply providing a platform and tools to both educators and learners to connect with each other, make content, teach and learn. Some popular examples are Udemy, UrbanPro etc.

Managed Marketplace: The learner's experience plays a big role in determining the success of the company, and an open marketplace dilutes the control on the quality of teachers, curriculum and methodology. Hence, some startups curate and manage one or more of these parameters. Example- Coursera partners only with the top universities and educators to teach, Whitehatjr provides the curriculum and training to its educators etc.

SAAS (Software-as-a-service): In the last few years, we have seen multiple companies emerge to provide tools to the educators to enable them in going digital. Companies like Embibe, Classplus, XSeed etc. are enabling institutions to go online, teach, evaluate, create and publish content.

Servicing through inhouse content and sales: This is the classic media approach where you invest in creating good quality content, package it and sell aggressively in order to recover the investment and make profits. A classic example is Byju's, which has become the world's largest Edtech company, today. Others in higher ed/ upskilling space like Upgrad, Pesto, Interview bits also fall under the same model.

Some companies have tried multiple approaches and have also moved between them. For example, Unacademy started with a managed marketplace model I guess and now hires the best faculty in each domain on its payroll, hence managing everything in-house. It continues to have multiple part-time teachers perhaps and also an incentive for them based on the number of students who come through their referral.

LIVE vs Recorded content

This is another important question an Edtech company has to answer. Rather, decide whether to build content in-house or not in the first place. Today, there is so much content available on the internet that one can even curate the entire curriculum/ content or acquire it from a third party. For example- the coding for kids startups are more or less using the same curriculum and methodology. Content has become a commodity unless you are creating high quality animated content and turning it into your IP, like Byju’s.

Coming back to the LIVE vs recorded conundrum, it will define the kind of company you want to build. Recorded content is usually packaged and sold aggressively (like Byju’s) whereas the startups that have the LIVE classes model tend to offer a free trial and convert their users. For eg- Swiflearn, Openhouse, Vedantu (in K12).

But increasingly startups are moving towards a combination of LIVE plus recorded content, which is a good way to approach the problem. It clubs the benefits of LIVE (engaging, accountability, peer learning, attentiveness, doubt solving, personal touch etc.) with the benefits of recorded (convenience/ flexibility, study at own speed, accessibility, economies of scale etc). Players like Unacademy have executed this combined approach well.

Geographies targeted

I wouldn't have highlighted this element a few years back perhaps, but now we are increasingly witnessing a set of companies targeting international markets from India. Some have started as global companies from Day 1, the likes of Splashlearn, Quizizz, Skillmatics, Eruditus, Great Learning etc. while others have launched global markets after testing the ground in India, such as Byju's, Whitehatjr, Cuemath, Miko etc.

This very possibility of building a global company has perhaps increased the size of Indian Edtech market multi-fold, given the high ARPU and scale potential in developed and developing economies worldwide. The margins are much higher and there is a huge potential of edtech companies becoming the Infosys-TCS of IT Market, because of the services component and cost arbitrage involved.

Although the curriculum, language and methodology makes it less standardised than other markets. But you should definitely start understanding the behavior of stakeholders in other markets if you are into Edtech. From what I know, there is a large Indian diaspora in UAE, US, Singapore etc. And consumers in these countries also have a very similar behavior in terms of parents doing everything they can for the children, preference towards affordable 1-1/ small group classes.

And ofcourse the tail winds created by pandemic has made online education beyond geographies very much feasible. The pandemic has also made Edtech the favorite sector for every investor. People are hailing Edtech as the new E-commerce as Indian edtech startups have raised over $1.5B in first three quarters of 2020 (compared to ~400M in entire 2019). And, understandably so!

Market Map

Now based on the above segments and models, here is a quick market map of the key players. Please note this graph is only representative of the different segments in the market and is in no way exhaustive. We will try and deepdive into some segments exclusively later below.

Note: There are some unconventional/ offbeat segments like Educational Games, Digital Toys etc. like Miko, Skillmatics, Flintobox etc. which are seeing great adoption. Another category within Higher Ed is Overseas Education with players like Leverage Edu and Leap Scholar organising the largely unorganised market. We will talk about more such segments later.

Is there a major market segment or business model I might have missed? Please DM.

What really works and what doesn’t to build a large company?

Now, let's have a look at the key insights in Education based on what has worked and what hasn’t for these players.

Most of the revenue is 'Sales Led' vs. 'Direct Inbound Purchases'

I am not implying that there is less demand. There is definitely a lot of inbound interest and most of the online users are inbound. But when it comes to purchasing the products, marketing alone does not close the deal. It is usually followed by aggressive sales on the inbound leads. The average value of a purchase is usually significantly high in Edtech. Now whether it is the cause or the result, we will let you ponder over it. But due to several factors such as high competition, super fragmented and largely commoditized market, the inertia of buyers (parents or schools), the trust required to commit to a 'course/ program' and low brand presence, most of the revenue comes only when you do hard consultative sales/ counselling (as coined by multiple players).

But what really sells, you ask? Is it the product or the service? Is it the teacher or the content? Is it the brand name or results?

A good question, but it hardly matters as long as you can ‘sell’. With the risk of generalising the market, what has largely worked in the market is rather this:

Fear of parents that they might not be doing their best for their children (societal pressure/ status/ concern about the future). Every parent today, income agnostic, understands the value of education and would go above and beyond to do the best for their children. Now, the concern is that parents don't necessarily know what's best. And, to bridge this information asymmetry, the market player which makes the most noise and sells the dream backed by fear of not investing in the dream, wins the deal.

This particular fear works most in the K12 market, followed by test prep. And we know which players have done this well!Fear of not being able to achieve 'Goals' or the ambition to achieve 'Goals'. Though this might seem related to the first one, this is the segment where outcomes do matter. Where outcomes can be sold. Where a good product can win, but the caveat is that it is equally tough to scale outcomes.

There are again two types of players in this segment. Those who promise results and sell aggressively, and second those who drive results and sell them. The test prep market has both, and of course the ones leading the market are the latter. From Aakash to Allen, they have had years of stellar results which has made them what they are today. But they have been a little late/ incompetent to the Edtech party, where the likes of Unacademy managed to do both. They brought in the best teachers thus attracting the crowd and also built out an online managed marketplace in a classic supply-first approach. They focussed on specific exams to start with, and then added more exam categories as they scaled, bringing best teachers in each segment onboard. Additionally, their distribution first approach of offering free content through Youtube influencers helped them operate with economies of scale when they onboarded the high $ teachers.Beyond the test prep, the higher education market is now embracing the ISA-like models (Income Sharing Agreement) where the outcome is tied to the revenue of the company (you pay the fee only if you get a job). Again, it’s challenging to crack at scale, but the ones who can do it can make profitable, purposeful and genuine impact-creating platforms. Here again, the play is on the fear of not getting a good job, and ISA/ job guarantee makes it even more lucrative. This approach is working well for both ISA and pre-payment models.

Signalling, Status and Degree. This again is linked to fear somewhere, but is also more aspirational and status-seeking. A tier-1 institute degree helps you signal your intellect in a crowded pool of candidates, but not having one doesn’t guarantee the lack of it. People wanting to earn a degree helps the traditional institutes survive despite their curriculum, teachers and methodology being obsolete and failing to help students get the right jobs.

That is what sells. Now let’s talk about what people seek additionally, especially in higher education and what most online players have failed to realise/ offer. Any guess? It's pretty straightforward. If you think why people actually go to a higher education institute, other than for classroom learning, it's this-

Making friends and hanging out with them during/ after college

Activities, clubs, and extracurriculars with other students

Sports

Dating

Co-living

Credentials/ degree

Alumni network

Job/ Placements

Status

Hence, there lies a huge potential for digital-first companies in higher education to think about how they can offer digitally what students seek in offline institutes till date. Or even take an omni-channel approach?

You can unbundle these key elements and rebundle them in different shapes and forms, offering much higher value for money and better outcomes.

Do you have any other insights on what works/ what doesn’t? Would love to hear. Comment below or DM me.

Whitespaces and Opportunities in Edtech

With the above context set, sharing a high-level view of the whitespaces that exist and might make for a great business opportunity.

In the K12 market:

Extra-curriculars (1-1 and cohort-based both)

Live cohort-based online classes (replicating offline fixed-time tuitions)

Doubt-solving by segment will continue to be a huge acquisition play

In Higher Education/ Continuous learning:

Skilling + Placements combined (both tech and non-tech) (vertical players)

Live + recorded cohort-based learning programs (by individual creators)

High-quality micro-learning content in regional languages for upskilling

What are some other whitespaces that exist according to you? Please comment below or DM me.

We will do further deep-dives into the K12 and Higher ed market on a different day, but here are some key market players in each segment.

Key Market Players in Higher Ed by segments (tech vs. non-tech) and type of payment/ goal (skilling vs. jobs)

*Note the above chart is a representation of the space and not exhaustive in any way.

We also have some community-led upskilling players with a mix of free and paid content like Avalon Meta, Network Capital etc. They surely have a huge potential, if they are able to crack the motivation layer at scale. The problem in higher education/ upskilling isn’t content, but the motivation to learn in the first place. <5% of the youth actually want to learn. They don’t even google stuff, unfortunately. This can be either solved through consultative sales, or ______. I will let you fill the blank here. Do ping me with your thoughts if you have read till here!

Additionally, most of the quality content available right now in higher ed/ continuous learning is in English, but there is an even bigger population who prefer regional language content. Josh Skills (part of Josh Talks) is building in this space, backed by their massive distribution on Youtube through TED-like videos. Youtube has and will continue to be a good source for building trust and for user acquisition/ community building. Another player in higher ed space, GUVI, is building regional language courses for teaching programming.

Then there are some vertical players in skilling which are focussing on a particular sector, like Virohan in Healthcare, Skill-Lync in Mechanical/ Electrical engineering etc.

Within the Higher ed/ Continuous learning space, there are well-funded startups which are targeting the global market from India and selling high ARPU courses (even upwards of $5000) like Great Learning, Emeritus/ Eruditus, Upgrad etc.

And another space which has been investors’ favourite over the last 1-2 years has been the Income Sharing Agreement (ISA) model, where the learners don’t have to pay the course fee upfront, rather pay a %age of their salary for X months only if they get a job above a certain threshold. The incentive of the institute is tied to the placement of the student, which creates a win-win for both. Some of the players in the tech-skilling ISA space are Scaler/ InterviewBits, Pesto, Masai School, Newton, Acciojob, Outscal, AttainU, Greyatom, Mountblue etc. And players like GUVI, Skill-Lync, Coding Blocks etc. offer pre-paid upskilling courses (Scaler is now pivoting towards the same as well). The non-tech ISA skilling space has some early-stage players like Able Jobs, Sunstone Eduversity etc. which look promising.

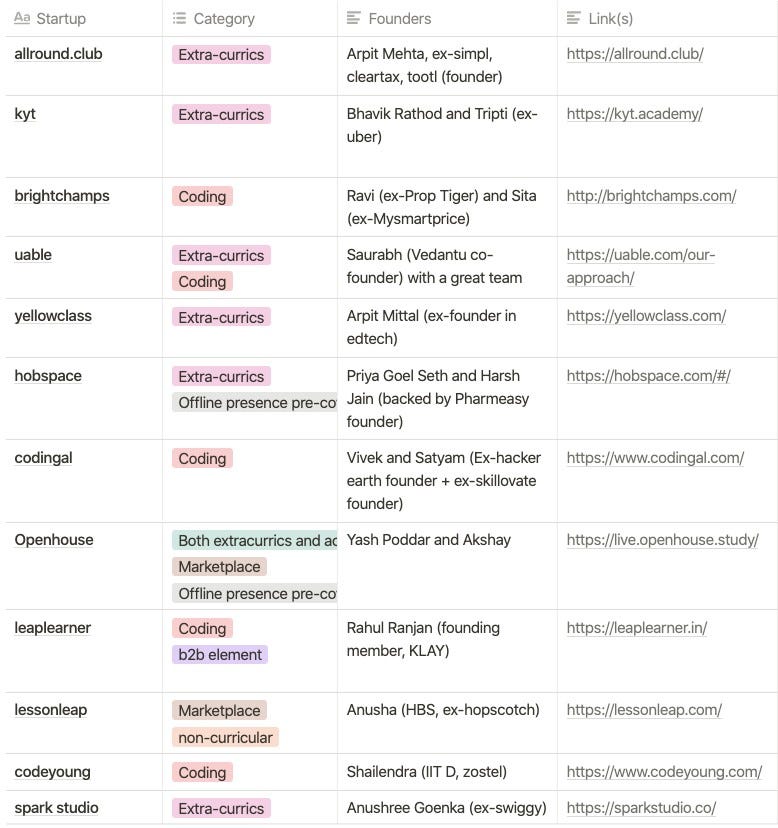

Startups emerging in the K12 Extra-curricular space. Almost all of them are backed by angels/ VCs and run by credible entrepreneurs, displaying confidence in the market

Other than these early-stage startups, the old giants in the space namely Vedantu, Byju’s (with WhiteHatJr), Toppr, Cuemath etc. might also be eyeing the extra-curricular/ co-curricular market, having already started with Coding.

Super excited to see how the space pans out! Hope you got a good operator view of the edtech ecosystem. I will try and do a second version of this piece where we will deep-dive into each of the market segments and analyse the whitespaces further.

If you have any questions or thoughts on the above, would love to hear from you- comment below or DM me.

If you enjoyed reading this, don’t forget to subscribe and share this with your friends.

We are new in the newsletter journey- do give us a shoutout on Twitter/ Linkedin if you think more people should read this!

Credits: Shout out to Jayesh for help on editing the piece.

Also, if you are someone looking to work in the Edtech space or start up, do reach out- have some interesting opportunities from our network.

FutureX is an invite-only community for curious life-long learners to keep up on business and tech trends, and develop mental models for a purposeful life.

Click here to join FutureX Learning community on WhatsApp.

If you are looking for a co-founder or to join a startup, join our startup fellowship program here or reach out.

What a brilliant read!

Awsome research paper Harry!!