The world of D2C brands and the potential

How and why the market is supporting emergence of D2C brands

by Jayesh Singh and Harry Kapoor

Hey there, FutureX is an invite-only community for curious life-long learners to stay on top of the latest trends in business and technology, deep-dive into different industries and business models, and exchange mental models, decision-making frameworks, and leadership principles.

Click here to join FutureX Learning community on WhatsApp.

To receive more such reads, consider subscribing to our newsletter 👇

At the dawn of a digital revolution, brands are persistently trying to redefine how they interact with their customers. Looking back through time, we see how it all started with the concept of direct selling with trained salesmen covering geographies on feet, going from door-to-door. Years later, brands have resorted to the same underpinnings of direct selling, only this time, in a digital embodiment.

Direct-To-Consumer (D2C) is a commerce strategy used by the brands to eliminate wholesalers, retailers, and distributors from their supply chain and instead, maintain direct relationships with the end consumers.

In the absence of retailers, the onus is upon the manufacturers to handle all retail operations, and sell to the end consumers directly.

As per an Inc42 report, there are already 500+ brands thriving on the D2C model in India.

Why go D2C?

For those inquisitive in the audience, let us explain why do brands bear the burden of adopting a digital-native approach over the traditional supply chain.

Better consumer understanding

As remarked in the masthead, D2C is the closest manufacturers have come to face-to-face interactions with the consumers. Companies have traditionally relied on market research for judging the feasibility of a new product. While it is a perfectly doable plan of action, a better one would include behavioural insights into customers' preferences collected by the companies. Why should retailers have all the fun? Feedbacks, product development, CRM funnels, market intelligence, and marketing have all been streamlined by the onset of D2C.

Increased margins

This one seems to be the obvious benefit of eliminating intermediaries from the supply chain. However, going D2C does not mean to cut off retail-related operations, only to subsume them under the manufacturer's jurisdiction. The cost of setting up retail and marketing operations should never eclipse the benefits of ridding away borrowed supply chains. Once coped with the expensive distribution, brands frequently enjoy margins increased by orders of magnitude.

Control over the brand

Companies following the D2C model typically command much greater control over their brands than they would have otherwise. Branding is more than just packaging or ATL marketing, it is a product's perception in the minds of its consumers. It is influenced by customer experience, genuine relationships, distinct positioning, and understanding - All of which are beyond the scope of an ordinary B2C model, yet within a comfortable reach of its D2C equivalent.

Flexibility in product management

Introducing a new product in the market is an unsettling endeavour. The shallow conclusions of market research do little to comfort the risk-averse retailers, who'd rather look out for past sales records as a testament to the product's demand. D2C leaves no scope for risk-aversion. A product's risk is only as severe as is anticipated by its manufacturers. To ascertain the demand, D2C offers the flexibility to introduce a product and run beta tests across select demographics.

Seems like a worthwhile enterprise?

Industry Landscape

What's the potential for D2C brands?

D2C is just a channel to do commerce. Some brands may choose to go entirely D2C while some will adopt it as one of their many channels. And as we discuss later below, Direct-To-Consumer brands can further also have both online and offline channels. We will try to estimate the market size of D2C in India.

As per IBEF estimates, the Indian E-Commerce market would grow to $200 Billion by 2026 from $38.5 Billion as of 2017.

The United States' online D2C market makes up to 5% of their eCommerce sales. A linear extrapolation would give us an estimate of $10 Billion worth of sales in the Indian online D2C space, by 2026.

Now, it would be a reasonable assumption to consider offline D2C sales approximately equal to (or even greater than) the online counterpart, especially when you consider brands like Nykaa, Epigamia etc.

Predicated over our assumption, we could expect the Indian Direct-to-Consumer market to grow to $20-30 Billion, by 2026.

Brace yourselves to deep dive into an intriguing industry that promises to burgeon far and wide in the near future.

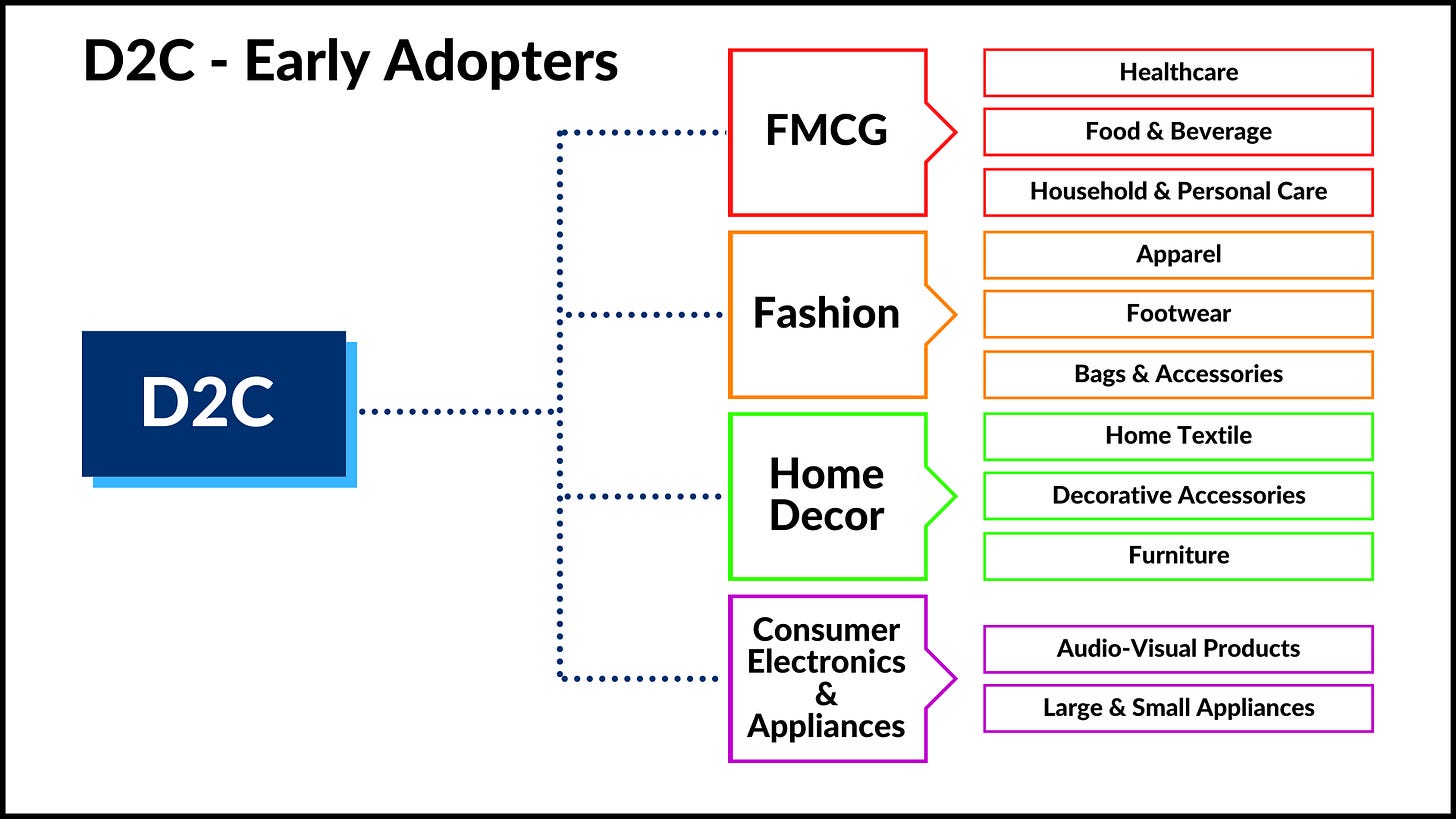

Who have been the early adopters riding the D2C wave?

The Direct-to-Consumer trend was understandably pioneered by easy to ship products like skincare, makeup, and fashion. Following the first wave, industries like FMCG, decor, and consumer electronics were the next to ride the bandwagon.

These industries compound the majority of Indian D2C landscape.

Source: Inc42

With time, the companies are now spearheading into the unconventional D2C verticals — from vehicles (Tesla) to airfare (LinearAir), all the way through to fertility tests (Modern Fertility).

While the United States has spawned Direct-to-Consumer Unicorns, India still has a long road to follow. Though in the nascent stage, Indian players have assured the potential for growth by clocking revenues over $15MM per annum already, and have reported valuations of more than $100MM.

Let's study closely the nuts and bolts of the D2C marketplace.

What are the different models in D2C commerce?

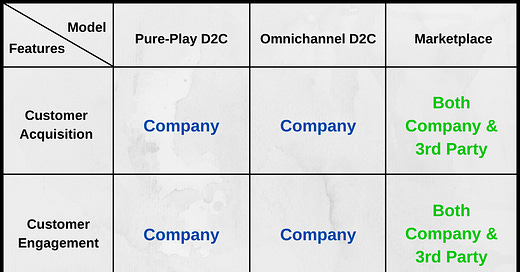

Delving deeper into the anatomy of Indian D2C space, we see a range of models depending on the parts of the customer journey handled by the brand. The following matrix sheds light on the most prominent of these models.

Pure-Play D2C Model

In the purview of eCommerce, pure-play companies are those that rely completely on their digital presence to serve the customers. They do not have an offline presence.

Indian markets have witnessed pure-play D2C brands like Bewakoof, Melorra, and Country Delight trudge up the competition.

Pure-play D2C brands would typically deliver products end-to-end, and manage all the intermediary stages while eliminating all middlemen.

However, that may not always be the case. These brands often rely on contract manufacturing to save them the colossal financial burden, and third-party logistics partners (like Delhivery, Shadowfax etc.) to take care of the last-mile delivery operations.

Omnichannel D2C Model

As customer experience takes a more central role in the purchase decision, brands have been gushing to build an omnichannel ecosystem. Its core construct is to synchronize the data obtained across different points of contact with the consumer. Companies using the omnichannel approach unify customer engagement across brick & mortar stores, eCommerce, mobile applications, social media etc. into an aggregated distribution system.

A few of them invest primarily in their retail establishments like Nykaa, Lenskart etc. While others emphasize over their native eCommerce channels like Sleepy Owl, The Souled Store etc.

Marketplace

Some brands integrate marketplaces like Amazon, BigBasket, Grofers etc. into their channel mix. The low- and medium-volume enterprises partner with e-marketplaces while outsourcing several segments of the value chain. As an example, Sleepy Owl ships a part of its product range through Amazon to its customers.

We may also see hyperlocal players like Dunzo, Swiggy, Zomato etc. directly partnering with D2C brands to deliver and take a heavy cut because of the reach and data that they can provide to the D2C brands.

Shopify like platforms enabling D2C brands

Many D2C companies use platforms like Shopify, Magento etc. on the back-end to power their website, orders, fulfilment and engagement.

For example, Raymond used Shopify to consolidate its omnichannel strategy where it leveraged from Shopify's tools for the fulfilment, delivery, and customer engagement.

Source: Pattern.com

Traditional Players adopting D2C

Of the last sorts are the traditional rich players in the market looking to keep up with the changing times. Unilever, a large legacy retailer made one of the first D2C acquisitions by acquiring the Dollar Shave Club for $1 Billion in 2016.

A more recent and Indian version of the same would be when Marico acquired Beardo for Rs. 350 Crores back in July 2020. Let's talk about the big guns for a minute.

The Mass Adaptation

"Companies thought they were successful due to branding and marketing. The truth is their supply chain strength carried them", says Maz Amirahmadi, chief executive of ABN Impact.

Much like Unilever, many giants across a range of industries have learnt the prospects of going D2C. Since then, it has been a prolific race of acquisitions and innovations. To testify the prospects of D2C, we look over Nike's (one of the largest omnichannel player) YoY growth from D2C against wholesale.

The COVID-19 outbreak has only been a catalyst to the trend.

When Lockdown hit India, Mahindra & Mahindra responded with an online direct-to-consumer model that ran along with their traditional supply chain. The idea was to facilitate their customers the convenience of ordering their cars from the comfort of their couch, while also assuring contactless delivery. Multitudes of brands soon joined the D2C club.

Discovery India has launched its direct-to-consumer aggregated OTT platform, 'Discovery Plus' amidst the pandemic.

While the brands make the buzz, what about the large Unorganised Direct-to-Consumer SME market

While the large, VC-backed players make widespread headlines, there are a plethora of small and medium-sized enterprises that operate from the shadows. In the United States, D2C SMEs are leveraging Shopify to build a storefront and serve their customers better than ever before.

Indian market differs from the US in more ways than one. Indian SMEs typically look for low-cost, low-tech, and simplified tools to solve their problems. Accommodating these specifications, a wave of Shopify-like platforms, candidly known as Dukaan-Tech has emerged.

Players like Khatabook, OkCredit, Bikayi, Dotpe, Dukaan etc. strive to enable a Direct-to-Consumer existence for small merchants like kirana stores and pan shops. Collectively, the Dukaan-tech players are adding a new dimension to the unorganised D2C market.

Stumbling Blocks

Speaking of mass adaptation, the glistening reputation of the D2C space often cloaks a danger that lurks in the shadows.

To maintain symmetry in our discussion, we look at the largest stumbling block that brands best avoid - Copycat competitors.

Source: eMarketer.com

Marketers worldwide have echoed this sentiment. 58% of the respondents in a study acknowledge 'copycat competitors' as the one threat D2C brands may not foresee, claim The CMO Club & Epsilon. Let me elaborate on that.

Back in 2010, Lenskart, following in the footsteps of Warby Parker, had disrupted the Indian eyewear industry by making it possible to conveniently order eyeglasses online for the first time. Following the disruption, dozens of competitors emerged, all trying to get a slice of the online eyewear "pie".

Every leap in the world of D2C is followed by a wave of competitors replicating the business model, hoping to churn profits off the opportunity.

Other key challenges

Establishing a distribution network as strong as that of large established players will be a challenge to scale the business

Retention of users and building loyalty in the Indian market which is discount-seeking, and extremely crowded

Being able to serve users beyond the premium market (top 5%) i.e. catering to the price-conscious middle class of India

Why can't Indian D2C brands enjoy the global high ARPU markets? They can.

We are increasingly seeing many serial entrepreneurs start global companies out of India.

Skillmatics, a Mumbai startup became the first Indian brand to sell across Hamleys globally. With a vertically integrated supply chain and in-house manufacturing to rapidly iterate, launch, and scale new products, they seek to disrupt the global toys and games market. They also sell globally via Amazon.

In April 2019, they became one of the 17 startups for Surge (Sequoia's accelerator programme for early-stage startups in India and Southeast Asia) while raising around $1.5 Million in seed funding.

Meanwhile, Vahdam Teas sold over 20 Million cups of tea online across 76 countries in 2 years. The problem they seek to solve could best be explained in the founder's own words, "If you look at the supply chain for exporting from India, it’s completely broken. The goods go through distributors, then get sold to exporters. Somewhere in the middle, brokers show up too. Then an importer imports the tea. It all takes months to get a supply cycle to reach consumers."

They challenge the broken chain by sourcing fresh tea leaves directly from 100s of gardens across India within 2-3 days of the harvest. The goods are stored in their Delhi warehouse, from where they are shipped overseas to their entities in different markets. Strong control of the supply chain gives Vahdam Teas the competitive edge. With freshness at the centre of their value proposition, Vahdam teas have raised $40 MM till date.

The not-so-common product range

The direct-to-consumer market needs innovation and creativity. Both of which were supplemented to good measure, by Wakefit. The 'sleep solutions' company has made headlines for offering the dream job, as a guerilla marketing campaign. They unveiled a 'sleep internship' for those who could sleep for 9 hours a day for 100 days, with a stipend of Rs. 1 Lakh. Launched in 2016, the mattress manufacturing company has seen a 3x rise in its annual revenue since its inception.

A strong brand positioning has been the success mantra for Wakefit, who has always emphasized on making lives easier by creating the best bedspace experiences. The climbing reach of Wakefit is a product of their ineffable marketing campaigns around healthy sleep routines executed on a shoestring budget.

Speaking of 'healthy', a Milktech startup has been making its way into the D2C ecosystem having served 200,000 families across Delhi, Mumbai, Pune, and Bengaluru. Country Delight has built a subscription-based 'farm-to-table' business model that delivers fresh milk to the doorstep within 24 to 36 hours.

Their good unit economics driven by a strong on-the-ground execution makes them a potentially disruptive consumer brand across the country.

Having mapped the Direct-to-Consumer space across India, here are a few startup trends/ ideas that might add immense value to the D2C sphere

The window of opportunity:

A platform for building an offline presence for D2C brands

With brands increasingly relying on an Omnichannel strategy to engage with their customers, there is a huge scope for a platform that allows you to build your offline distribution in key metro cities.

The platform can partner with retail chains and mid-size stores on one side and with D2C brands on another. They can offer a live platform to bookshelf space, view and manage inventory across stores, customer relationship management, and logistics support.

Even for the retailers, it will provide a good opportunity to increase their revenue stream, offer new products and importantly manage the relationship with multiple brands through one platform (similar to the way Limetray acts for restaurants, aggregating orders from all delivery partners).

This can be best done by players who are trying to digitize the retail stores offering solutions for inventory management, customer relationship, transactions recording and payments.

Contract Manufacturers-as-a-service (CMAAS) to launch D2C brands (as a feature? :P)

We know that distribution is one of the most important factors in building a D2C brand, rather FMCG companies like HUL, P&G etc., clothing brands like Levi's, Louis Philippe, Allen Solly etc are all marketing companies in the end. They contract manufacture, inspect quality, and sell under their brand.

Similarly, celebrities and influencers in India and worldwide are launching their own private label brands. For example, Hrithik Roshan, Virat Kohli, Deepika Padukone etc. launched their brands in partnership with Myntra. Salman Khan recently launched his personal care brand FRSH.

To enable the influencers or anyone else, say a content/ media company to launch a private label D2C brand, contract manufacturing as a service combined with a Shopify-like platform will make it easy to launch new brands. It will also add immense value to the manufacturers' business.

Zilingo is an appropriate example of the model that works across the fashion industry.

Interestingly, a reverse service that enables a manufacturer to build a brand and build distribution with services like marketing, inventory management, logistics, customer relationship etc. might also be feasible but building a D2C brand is also about understanding the consumer mindset, hence the market for this wouldn't be as attractive.

All-in-one platform for SMEs to launch small-scale D2C brands (powered by the wave of Dukaan-tech)

Shopify pioneered the concept which was then adopted by multiple players across the world who made it more accessible to the smaller enterprises to build an online brand at low cost and simple setup. In the Indian ecosystem, there has been a recent wave of Dukaan-tech players who are attempting the same. It will be interesting to see which of them can enable these SMEs to build an end-to-end online brand.

Companies like Dukaan by Growthpond, OkCredit, Mystore by Khatabook, Dotpe, Bikayi etc. are the current front runners in enabling local businesses to set up an online store, manage ledgers, and maintain customer relationships.

A social media, content and influencer agency to launch D2C brands (by vertical or horizontal) which appeals to millennials and can drive early adopters and influencers

What are the other whitespaces and opportunities you see for building platforms for D2C? And any specific categories where you see more D2C brands coming up and building a large business?

That's all for today. Promise to meet you again and discuss another market landscape. Till then, read our other stories.

And if you liked reading, share this with friends who might find it useful and subscribe if you haven’t already.