Can Social + Commerce compete with Amazon to be the next shopping destination?

Mapping the social commerce landscape in India, deriving learnings from China and exploring the potential opportunities that lie ahead

By Rachita Kumar and Jayesh Singh

Hey there, FutureX is an invite-only community for curious life-long learners to stay on top of the latest trends in business and technology, deep-dive into different industries and business models, and exchange mental models, decision-making frameworks, and leadership principles.

Click here to join the FutureX Learning community on WhatsApp.

Social commerce, the integration of social interactions and commerce is changing the way commerce happens in India and around the world. As Connie Chan highlights, "the next Amazon competitor is likely going to look like a social or video app, not a shopping app.". With increasing internet penetration, increased time spent on social media, lack of trust in traditional e-commerce channels, and movement from search-led to discovery-led commerce, social commerce is well-positioned to drive the next leg of growth for e-commerce. As we write this piece, the Indian social commerce landscape just got its first unicorn, Meesho, valued at $2.1bn in the latest fundraise.

This piece is an attempt to understand various aspects of social commerce in India, and we will divide this piece as follows:

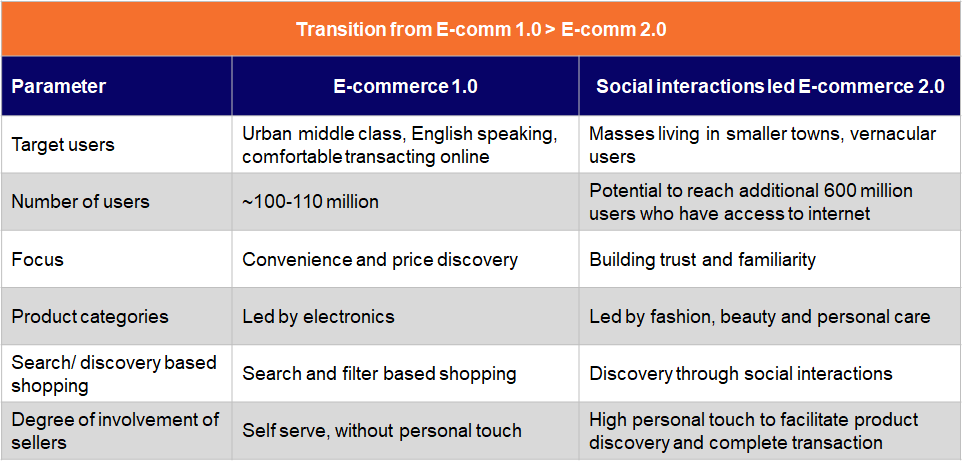

The transition from e-commerce 1.0 to Social interactions-led e-commerce 2.0, examining the rise of social and parallels from China.

Market landscape of social commerce.

Mapping the operating models in social commerce.

Challenges for entrepreneurs.

Opportunities and whitespaces.

We publish interesting deep-dives on various industries, startup trends, and business models. If you haven’t already, subscribe to the newsletter to receive these in your inbox 👇

Transition from e-commerce 1.0 to Social Interactions led e-commerce 2.0

Since forever, the golden rule of commerce has always been to try and place your businesses wherever their customers are most frequent. The Indian e-commerce industry marks no exception. Its trajectory has always been to orbit around the likes of the end consumers. However, the definition of the target market and channels to reach the end consumer have changed over time. That is what has marked the transition from e-commerce 1.0 to social-led e-commerce 2.0.

E-commerce 1.0 in its most fundamental form revolved around making the consumer experience more convenient than offline purchase - focusing on price discovery, product availability, speed of delivery, return policy, etc. The landscape has now begun to evolve. Jiofication has extended internet access to nearly 700 million Indians, percolating through to tier 3/4 cities.

But even though access to the internet has increased,

Only 100-110 million transact online, i.e. only 8% of Indians shop for products online.

The e-commerce segment in India accounts for just 3.4% of the overall retail market.

Other than electronics, most of the other categories have low internet penetration.

For the majority of non-transactors, lack of trust is the biggest impediment to online commerce.

Social commerce is the key to addressing this trust deficit in our economy. Social Commerce is the stellar concept that blends e-commerce and social interactions into what appears to be the future of e-commerce. The notion of S-commerce uniquely satisfies a bunch of consumer needs like:

Product variety and customization

Community's connectivity

Convenience

The scope of bargaining

Engaging experience

The rise of social

Society has always had a major role to play in a person's commercial choices.

We're no strangers to the aunties in the neighbourhood selling products from Amway and Tupperware - executing upon a model reliant on their personal reach and leveraging from their recommendation and influence. This was probably the first manifestation of social commerce in the modern world. Word of mouth has always been among the strongest motivators to elicit a decision.

Social e-commerce is a digital adaptation of that very principle. A social network is characterized by a vast community of people positioned to interact with each other on a wide range of interests.

Ahead of its time, Yahoo Shopping in 2005 adopted the salient features of a social network into an eCommerce context. It let users create, find, and share product reviews and recommendations among many others. This was also when Yahoo first coined the term - 'Social Commerce'.

The idea caught wider coverage in 2007 when Facebook introduced its Marketplace for the first time. Today, people sell everything from furniture, appliances, flats, cycles etc on the marketplace.

In the subsequent years, more social media giants like Twitter, Tumblr etc. entered the league and lost. Today, we're left with Facebook's shoppable pages, Instagram's Buy Now buttons, and Pinterest's Buyable Pins.

With time, brands are innovating and experimenting their way into social commerce:

Tiktok partnered with Shopify to help over 1 Mn merchants reach the younger audience of TikTok.

Snapchat is experimenting with Augmented Reality in its filters to gain an edge over other social media players in S-commerce.

Paytm leveraged its vast user base of merchants and the existing logistics of Paytm mall to launch 'My Store', a social commerce platform on the Paytm for business application.

Indians spend an average of three hours a day online. More than two of which are spent over messaging, social media networking, and watching videos. Consequently, loads of businesses in recent times have come swarming in to get a piece of the (tremendously increasing) S-Commerce pie.

But, there's one market that's paving the way for the rest of the world.

China, leading the way

Social commerce in China has grown rapidly and now constitutes close to 15% of e-commerce GMV. Pinduoduo (PDD), the largest social commerce player, accounts for 14% of total e-commerce GMV in China with annual active buyers reaching 97% of Alibaba’s active buyers. When PDD was launched, JD and BABA generated a combined GMV of $433 bn. Within five years, PDD has gone from a start-up to a $200bn market cap company, a huge feat for a startup competing in such a competitive space.

What are the factors that led to PDD's success?

Leverage of social networks such as WeChat and QQ, to allow a “team captain” to share the product with friends and relatives to form a team and get a discounted price.

Greater appeal to customers in lower-tier cities and lower-income buckets due to its value-for-money product selection.

Team purchasing model appealing to bargain-seeking and price-conscious buyers.

These factors brought customers on board who were not active in online shopping before. We see a similar trend shaping up in India, with social commerce players serving an unmet need of customers and solving for similar pain points.

Traversing through the $2000 GDP per capita mark, India is expected to see an upheaval in consumer spending, as observed across most developing countries. The internet penetration in India and an expected increase in household income direct towards more e-commerce transactions with time. This could very well be the time for new digital-native businesses to produce hockey stick growth.

Venture capitalists in India are hoping social commerce will be the next big thing, akin to how it has shown growth in China. However, it is worth noting that the Indian social commerce market has different dynamics than the Chinese market. Early entrants into Indian social commerce are working through the reseller model (outlined in the ‘operating models’ section below) whereas the Chinese social commerce model grew on the back of group buying, time-sensitive bidding, and lucky draws. Hence a direct comparison with the Chinese market would not be accurate. That said, Indian entrepreneurs are leveraging other models to bring to market the next set of customers.

Now that we've set the premises for social commerce's growth, let's dive right into the Indian market dynamics.

The market landscape for Social Commerce

Market Size

Indian S-commerce is expected to grow from a $1.5-2 Billion GMV market in 2020 to $16-20 Billion in mere 5 years. And, to $60-70 Billion by 2030. Yes, you got that right - Twice the size of the current e-commerce market.

Who sells on Social?

Social Commerce in India particularly appeals to two segments of sellers:

Who buys on Social?

Unlike e-commerce 1.0 where the majority of buyers still are urban English-speaking affluent consumers from Tier 1 cities, social commerce transcends to vernacular, not so tech-savvy first-time internet users of Tier 2 and 3 cities. 55% of social commerce customers are estimated to be from Tier-II cities and beyond. These users are comfortable using Whatsapp and spend more than ~2 hours on the internet on Facebook and other social media/ video apps. Given the trust issues highlighted earlier, these customers prefer purchasing from someone they know. In many cases do not have a clear idea of what they want and are open to discovering new products through social interactions vs actively searching the product on Flipkart/ Amazon.

What sells on Social?

While traditional e-commerce is driven by electronics, fashion is the largest category in S-commerce, followed by personal care, and food & grocery. These are high trust categories (grocery sales are still dominated by kiranas with 90% of retail market share due to the trust won by them) that require community connection (validation from friends while buying clothing/ cosmetics), and are more discovery-led than search-led transactions (wanting to buy that pair of shoes worn by your favourite influencer) and demand a fun shopping experience (bargaining/ group interactions while buying unbranded goods). That said, these aspects are best incorporated through the blend of social interactions and e-commerce.

To interact with their customers and transact in such high-touch categories, these sellers can choose from a wide range of social commerce platforms. Let's fetch an insight into the operating models of these platforms.

Business Models in S-Commerce

From the broadest perspective, the S-Commerce players adopt one of the five different operating models:

Reseller-led: These platforms target resellers who sell the products to their networks. These networks in many cases can be their families, friends, or in some cases, a hyperlocal professional network. Meesho has been leading the S-Commerce revolution in India since its inception led by the reseller model. Meesho has more than 7 million re-sellers on the platform, spread across 100 cities out of which 80% of them are women from smaller towns and cities. These women facilitate product discovery among their close networks and build familiarity and trust in the system. GlowRoad, Citymall, and Shop101 are other companies working using the reseller model. Companies using the reseller-led model work to build a technology platform, sign up sellers and then enlist resellers — those who would sell the merchandise of the sellers to their networks. The resellers would earn a self-determined mark-up and the platform would handle shipments, returns, and payments.

Sharechat is also exploring avenues of entering social commerce through its acquisition of Elanic. One of the potential ways its social commerce layer would work is that the resellers of existing social commerce companies such as Meesho will post on ShareChat to get customers.

For niche communities, social commerce is an interesting way to increase engagement and give earning opportunities to community members. For instance, Sheroes, a women-only social network, expanded into social commerce through SHECO, making its community members resellers, enabling them to identify themselves as businesswomen, and make money.

Traditional e-commerce led: Amazon, Myntra, Paytm etc are also experimenting with integrating social elements into the shopping experience. For instance, Amazon launched Amazon live, which features live-streamed video shows from Amazon talent as well as those from brands that broadcast their own live streams across categories including beauty, fitness etc, through a new app, Amazon Live Creator. This could be an attempt to move away from a text-centric, search-driven platform to one that delivers on discovery -- users open the app without a specific intent to buy, similar to going to the mall with no agenda. As highlighted earlier, Paytm is also venturing into social commerce through MyStore.

Experimentation with social commerce is not restricted to B2C e-commerce players. B2B eCommerce enabler, Instamojo ventured into S-commerce, leveraging its acquisition of GetMeAShop.

Social network led: Social networking platforms are adopting the functionality of an eCommerce marketplace. These are characterized by their massive existing audience, which they leverage to make way for brands to gain visibility and make sales. These players include the social media giants like Facebook, Instagram, Pinterest etc. Typically, retailers and resellers put adverts featuring their products on the platform. Shopify's integration with Facebook and Instagram represents an interesting dynamic of social commerce. Instagram and Facebook are slowly transforming from discovery platforms to commerce destinations. Phrases such as "swipe up to purchase," or "store link in bio," have become extremely popular calls to action. Last year, Facebook and Instagram rolled out Shops, turning business profiles into storefronts, and last month Shopify expanded its payment option, Shop Pay, to its merchants on Facebook and Instagram, making shopping on these social media platforms lot easier and ingrained in the user flow. Even WhatsApp messenger added a 'shop' button on the WhatsApp business application to integrate commerce over chat.

Influencer-led: The relatively newer category in S-Commerce is characterized by one-to-many interactions led by influencers. Foxy (Enanek), Bulbul, Simsim are few apps integrating influencer-led commerce into their apps. Most of the influencer interactions happen via videos, either pre-recorded or live streamed. Videos have emerged as the most powerful tool of conversion. As per Hubspot's research claims, 84% of consumers felt convinced enough to buy a product after watching a video about it. The new trend emerging among videos is shoppable videos. Youtube last year launched a new ad format that will make YouTube video ads more “shoppable” by adding browsable product images underneath the ad to drive traffic directly to brands’ product pages. Chingari also recently launched video commerce, making the videos on Chingari shoppable and generating affiliate revenues for the creators. Tiktok has also been experimenting with Shoppable videos through its partnership with Shopify

Mass Behavior led: These retailers motivate group buying through features such as social sharing, recommendations, virtual malls etc. For instance, the Jaipur-based eCommerce startup, DealShare has integrated group buying and allows the users to share links to the products and avail even more discounts (a model similar to Pinduoduo in China). It claims to offer cheaper deals than wholesale on items of daily use. The model has the potential to be loved by bargain-seeking Indians. In the graphic below, we have a few features of interest from DealShare's business model.

Challenges for entrepreneurs

Even though social commerce is seeing a lot of traction, the model has its own set of challenges.

High return rate due to poor product quality:

Social Commerce's primary proposition revolves around tier 3/4 markets with lower-priced and unbranded products. Naturally, S-commerce does not fare very well in terms of product quality, leading to return rates as high as 40% - 50%. High returns lead to piling up of inventory which could cause working capital issues for the platform

Entrepreneurs can curb that by introducing verification checks for quality to uphold the desirable standards. Furthermore, startups can consider incorporating augmented reality functions that'd allow buyers to demo the product before they make a purchase. Better satisfaction levels would lead to a decrease in the return rate.

Underdeveloped last-mile logistics in Tier 3/4 cities leading to high logistics cost:

The logistics system has to deepen in tier 3 and 4 markets where a large portion of the buyers come from. All of this got set up in China because platforms like Taobao, JD, and Tmall existed for a while and developed their in-house logistics. However, in India, last-mile logistics continues to be a challenge, putting pressure on the overall unit economics. Logistics and fulfilment costs account for the biggest share of total expenditure for most e-commerce players (38.6% for Meesho during FY20). Reverse logistics due to high return rates as mentioned above further add to the logistics cost.

Challenging unit economics

Even for scaled companies, unit economics has not improved, which could be a cause of concern for investors. Meesho spent Rs 2.14 to earn a single rupee of operating revenue in FY20. Even Pinduoduo has been consistently loss-making, though growing well and capturing market share. At a scale of $9.1billion in revenue for the year ended CY20, it posted an operating loss of $1.4billion.

Other than logistics cost, the other major cost is marketing expenses. For reselling platforms, marketing expenses are towards reseller acquisition and not direct customer acquisition. Given the high reliance on resellers (as highlighted below) and with the emergence of new players, the companies are spending heavily on advertisement, promotions and discounts on several media platforms including TVs and digital campaigns to push sales and onboard resellers, leading to high marketing expenses. Marketing expenses constituted about 33% of Meesho's FY20 total expenses. Meesho last year started advertising on TV with its latest ad that encourages women to open their own storefront.

Reliance on resellers/ influencers:

Platforms using the reseller/influencer-led model rely on the resellers/ influencer's ability to aggregate demand, hence reseller/ influencer stickiness is important. Moreover, the platforms do not have exclusivity agreements with the resellers, hence the resellers might be registered on multiple platforms or would switch to a different platform if they get higher margins, better product variety, quicker payments, etc. Reseller/ influencer churn is a critical metric to track for all social commerce companies.

Opportunities and Whitespaces

Social Commerce has just started to take shape in India and we can only imagine what it'd look like moving ahead. A few opportunities that we see in the S-commerce space are:

Influencer-led Social Commerce: Probably the most glamourous element of social media is its tendency to turn a few users into influencers. The influencers at different scales have been massively used for marketing by brands all around the world.

Social commerce players have started to work towards setting up and enabling micro-influencers to associate themselves with products over the platforms. Their impact could primarily be understood on three grounds:

Association: Connecting your brand to the influencer's existing identity and reputation.

Reach: Leveraging the audience of an influencer to extend the brand's reach.

Affinity: Creating brand alignment and creativity with the influencer.

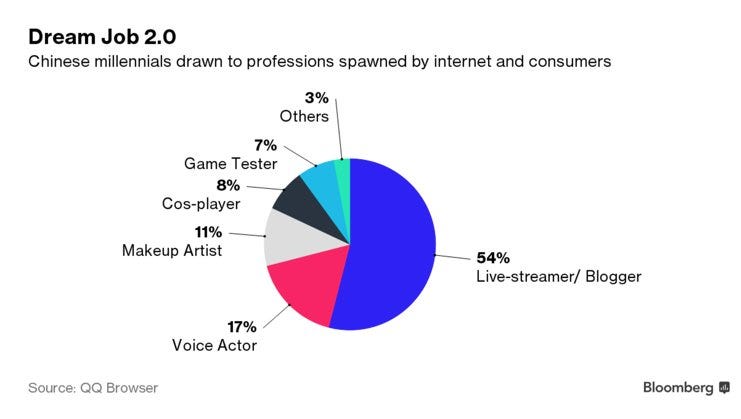

Even though we have seen the rise of influencers on platforms such as Instagram, the ability of the influencers to move sales is still limited in India, unlike in China, where the social commerce market is led by influencers, or Key Opinion Leaders (KOL) as they are called. Given the trust premise of social commerce, KOLs play a crucial role in influencing young consumers’ purchase decisions. For instance, Becky Li, dubbed “Mai Shen” – Chinese for “Goddess of Shopping” – sold 100 Mini Cooper Countryman cars within five minutes on her Becky’s Fantasy WeChat blog in 2017. Not just the cars, but KOLs in China can even sell rocket launches worth $5.6MM. We are yet to see this level of fan following, trust and massive influence on purchase decisions among Indian consumers.

The story of how Viya, China's star livestreamer who can sell anything from cosmetics💄to rocket launches 🚀

The story of how Viya, China's star livestreamer who can sell anything from cosmetics💄to rocket launches 🚀

Google has also jumped on the bandwagon through its latest project - Shoploop - a shopping platform designed to introduce consumers to new products through videos created by influencers.

An interesting trend in influencer marketing we see shaping up in China is virtual influencers. In fact, TMall Luxury Pavilion signed up a virtual model as brand ambassador - an “18-year-old model living in Paris” with supersized eyes and smooth skin. Virtual influencers have the benefit of being able to work nonstop. They don’t have any real ‘people’ problems and can sell products and work 24/7. Virtual influencers have the potential to change the way commerce happens as people become more receptive to this idea of a ‘virtual KOL,’ or any type of virtual entertainer.

Financial Services: The rise in gross merchandise value is an indicator of good market penetration and adoption of social commerce by consumers. Another key trend in social commerce could be for the platforms to launch their own embedded finance products - such as payment processing services, wallets (eg- Amazon Pay), lending to brands that sell on their platform or extending credit to influencers to launch their private label. Startups would probably have to wait for healthier retention before they could tap into this opportunity. Regardless, it offers extraordinary potential and another revenue line for the social commerce players.

Live Streaming: We talked about the video commerce players in the section above, though most of them rely on asynchronous video. The Indian live streaming market is still in its nascent stages with players like BulBul, SimSim etc experimenting with live streaming. And these interactions would happen in vernacular languages, given the target group of these platforms

Livestreaming also serves as a source of entertainment for the viewers and is also called Shopatainment by a16z. Livestream commerce leverages influencer streams on their social media and acts as online shopping malls. Impulse buying is a key factor affecting sales in live streaming. The perception of scarcity is a powerful psychological tool to get people to act fast, which leads to impulse buying. In a live stream, it’s even more intense because the time is shorter and there are a lot of other viewers who may be potential buyers, hence people feel more urgency to make the buy decision.

Livestreaming is a large market in China, estimated to be ~$60 Billion. Alibaba has a dedicated live streaming channel called Taobao Live which accounts for 80% of the Chinese Live stream commerce market. Such focused live streaming efforts by a traditional e-commerce company is currently a whitespace in India, and presents a huge opportunity given the potential to discover new products, witness live demonstrations and engage with the live streamer.

Here's a peek at how a live streaming app works. It's essentially a digital version of teleshopping + the opportunity to engage with the live streamer and ask questions.

It's #SinglesDay in China and I want to show you what the livestreaming shopping experience is like. It's a huge trend and Alibaba says they've seen this grow massively. This is Alibaba's Taobao app. And this is how some people shop. $BABA

It's #SinglesDay in China and I want to show you what the livestreaming shopping experience is like. It's a huge trend and Alibaba says they've seen this grow massively. This is Alibaba's Taobao app. And this is how some people shop. $BABANot only do people buy from live streamers, but they also dream to become live streamers. This is one key reason that has led to the proliferation of the live stream commerce market in China.

While we've generally seen live streamers selling beauty products, apparel etc, an interesting company a16z recently invested in is building for collectables - Whatnot - a live stream shopping platform and marketplace where users buy and sell collectables like Pokemon cards, sports cards, Funko Pops, and more. This shows the kind of potential of live streaming commerce to grow the overall e-commerce pie beyond the existing categories and consumers.

Serving the premium segment: With a few exceptions, social commerce players have been serving across the tier 3/4 geographies in India. The major whitespace that remains in the S-Commerce landscape would be the consumers with higher disposable income. While the adaptation curve of new social commerce players for luxury brands hasn't quite risen yet, these brands have definitely shown promise over social networking sites like Instagram, Facebook and Snapchat. It would be interesting to see if one of the competing startups launches a product line for premium goods or a luxury brand partners with a social commerce platform. For instance, luxury goods e-commerce platform Farfetch joined hands with Mr Bags, China’s top luxury handbag influencer to launch a co-branded WeChat Mini Program store – “Mr Bags with Farfetch”

There is also potential for a new social commerce player dedicated to luxury products. For eg. Xiaohongshu (Little Red Book in English) is a social commerce site dedicated to overseas luxury goods, primarily for fashion and beauty products. We could see luxury segment focused social commerce players emerge in India, expanding the pie of the social commerce users.

Private Label Brands: We have seen brands in all other formats of commerce like Big bazaar, Amazon, Reliance employ contract manufacturing to build their own private labels. As per a report by KPMG, private labels in India between 2019-22 are expected to grow 1.3-1.6x faster than e-commerce platforms and will generate 1.8-2.0x higher margins than external brands.

In the near future, as the existing companies mature, we could witness private labels in the social commerce space. Imagine Meesho introducing its own brand of casual wear that would essentially be targeting a digital flea market.

Products from influencers: The creator economy is burgeoning at an extraordinary rate. Creators and social media influencers are entrepreneurs in their own right. In recent times, we have seen influencers launch their own products, brands, media agencies and even cryptocurrencies, leveraging on their brand equity. Social commerce players can prove to be effective launch and distribution channels for them. In China, there are influencer incubators that help influencers launch their own brands. During Alibaba’s 11.11 Global Shopping Festival, Ruhan's (China’s largest influencer incubator) top influencer brand sold over $24.6 million in a single day. Ruhan’s influencer brand ranked eighth, in terms of sales volume, for top women’s fashion stores, only outsold by brands like H&M and UNIQLO.

Gamification: Brands across all commercial categories have consistently relied on gamification as one of their prime strategies. A game-like environment triggers positive human emotions. The better experiences then account for more engagement and finally materialize into more sales. In a bid to offer a gamified experience, we could see platforms incorporate scoreboards, badges, rewards and in-game currency for resellers or influencers.

Zomato offers a befitting case study where they had scaled their reviewing system to bring in more social functionality. As a result, restaurants started to pay for positive reviews, indicating the demand for positive endorsements.

Ideas like rewarding the highest engagement over an influencer's live stream could hold massive merit. With startups massively innovating on customer experiences by building virtual reality setups for a distinguished shopping experience or using augmented reality to build immersive product catalogues, the scope for gamification is now greater than ever.

SaaS tools: There is an opportunity for SaaS tools to help companies build Whatsapp/ Facebook storefronts, integrate their social media led sales into one dashboard, understand customer engagement with different influencers across channels and enable businesses to embed "live streaming as a feature". For instance, Business on Bot (YC W21) is building Whatsapp APIs to enable automated sales and user acquisition on WhatsApp for businesses in India, incorporating Vernacular Voice Chatbots and customer analytics dashboards.

The opportunities and potential for social commerce are huge. We are bullish on the social commerce space and excited to see how this unfolds in India. If you have any questions or thoughts on the above, would love to hear from you!

If you haven’t already, consider subscribing to our newsletter and give us a shoutout if this piece gave you some food for thought.👇

Sources:

Unlocking the Future of Commerce in India - Bain & Company

Social E-Commerce and Market Place 2.0 - Beyond Mental Models

Shopatainment: Video Shopping as Entertainment -a16z

Investors hunting for the next Pinduoduo in India - kr-asia

The online private label growth paradigm - KPMG

Please note that these views are personal and do not reflect the views of our employer. All data is taken from public sources.

In the past, we've discussed another emerging eCommerce trend, the direct-to-consumer model. Check it out if you haven't already.